Education loan obligations should be a big weight having homebuyers, delaying plans plus resulting in specific to place regarding homeownership entirely. Nevertheless the Biden Administration’s education loan forgiveness can offer certain recovery in the face of rising homes will set you back.

Reducing – and perhaps removing – debt tons through this offer system commonly raise obligations-to-money rates for the majority of borrowers. This may assist change alot more tenants to the residents regarding the upcoming decades.

Consumers may now make an application for beginner debt settlement

The policy – basic launched within the August – try a three-part plan that will forgive up to $20,000 for the education loan financial obligation getting reasonable- and you will middle-earnings borrowers. So you can qualify, their annual money in 2020 and 2021 must have become less than $125,000 once the one or under $250,000 since children. Applications might be unlock until .

How beginner debt impacts home buying

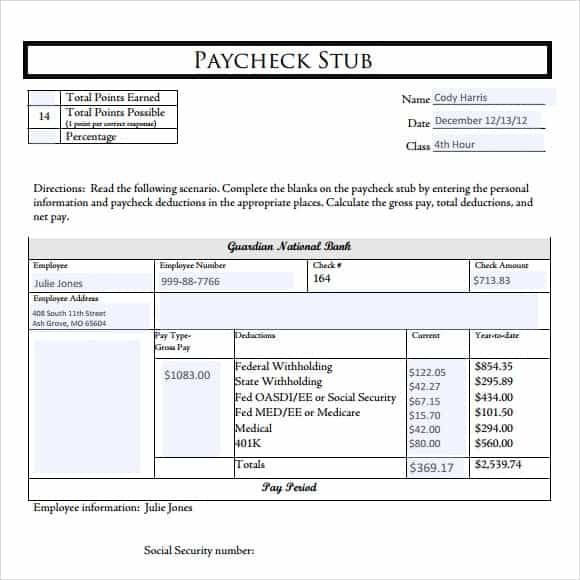

A switch scale loan providers use to determine if a debtor qualifies for a financial loan was loans-to-income (DTI) ratio. DTI measures up your own monthly financial obligation repayments for the gross month-to-month earnings and you may shows whether you can afford and make the home loan repayments.

As the DTI calculates their monthly financial weight, in addition, it provides you with a concept of how much home your can afford. When you’re several factors dictate mortgage qualifications, lenders have place DTI limitations to have individuals. Those proportion limitations are different of the financing type of:

- Old-fashioned loan: To 43% usually greet (36% is best)

- FHA loan: 43% usually welcome (50% is achievable)

- USDA financing: 41% is typical for the majority of lenders

- Va loan: 41% is common for the majority lenders

Education loan debt triggered 51% of all the consumers to put out-of or delay purchasing property inside 2021, predicated on a national Organization out-of Real estate professionals survey. Next, on twenty five% of all of the latest homebuyers and you may 37% regarding basic-timers had education loan loans, with the average amount of $31,000.

If you were to think such as financial obligation was holding you back out of homeownership, could Biden’s education loan rescue bundle make a difference?

Have a tendency to beginner credit card debt relief make a dent? Just what advantages think

The newest Biden Administration’s program is anticipated to include scores of college student financing debtors that have economic save. Of numerous following ponder exactly what the quantitative aftereffect of smaller personal debt loads could be to the property.

It may [provides a larger impact] from inside the a-year or more when property had been able to move on their residence purchasing timeline with less personal debt a fantastic.

We asked a threesome regarding housing market advantages because of their feedback towards count. Whenever you are indeed great for men and women seeking to financial obligation aid, the newest affect the genuine home business could be minimal. Some tips about what they had to state:

With regards to the White Household, the program will offer recovery so you can as much as 43 mil borrowers, along with canceling a full leftover equilibrium getting around 20 mil individuals.

To possess potential house buyers who are into the margin, the debt rescue you may allow them to make use of the money one would student loan financial obligation to store upwards having an effective advance payment. It may also offset a number of the value loss off ascending mortgage prices because what once was a student-based loan percentage normally feel section of a home loan commission.

Really don’t believe that student loan forgiveness get a lot of an impact on real estate. Consumers have previously got its costs suspended for a while today, and they’ve got were able to both reduce financing otherwise build up coupons.

Lenders have managed to generate improvements from inside the dealing with college student finance getting individuals until then bundle was at set, definition the online work for can be rather brief. It might, however, have a somewhat big impression for the annually or even more when houses was in fact able to move ahead their property to purchase schedule insurance firms smaller personal debt a great.

Once the education loan forgiveness operate may help some people change from renter so you’re able to consumer, its impractical we’ll note that happen in huge number. Having borrowers whoever obligations would-be dramatically damaged, they most likely might have eligible for home financing despite one to personal debt.

For borrowers which have half a dozen-shape education loan financial obligation, this new $ten,000 forgiveness probably will not be enough to go brand new needle. Your debt forgiveness could eradicate a mental hindrance for many consumers who had been vacillating ranging from trying to buy property and you will spending away from a lot more of its education loan. However, once again, I doubt that the amount of people so it affects get a content effect on full home sales.

College loans cannot stop you from to invest in property

If you don’t be eligible for brand new federal scholar debt settlement program or it only renders a low impact, you can nonetheless get home financing and purchase possessions.

Loan providers have autonomy in their underwriting. They’re forgiving regarding the student loan payments, especially if almost every other regions of your loan application – just like your credit history and you can down payment – is actually good. Loan providers might even reduce the amount of pupil financial obligation it consider when you’re from inside the a beneficial deferred payment plan otherwise income-determined repayment plan.

Your seriously can obtain a house with education loan financial obligation, mortgage expert Ivan Simental told you on an episode of The borrowed funds Profile Podcast. Simental suggests you to possible home buyers with education loan loans treat its DTI if you are paying down smaller financing, remain their cards stability lowest, and increase their credit scores when you can.

The conclusion

Just big date will state exactly how beginner credit card debt relief will help house consumers. It will be possible that the effect could well be restricted because the to invest in a good domestic and you will paying your own financing installment loans for bad credit in Richmond California of college or university aren’t collectively private.

When you need to purchase property but never learn whether or not your qualify on account of beginner personal debt, communicate with a loan provider. Regardless if your proportion are above the regular restriction, there is certainly conditions or some other mortgage types of that ideal suits your.