Selecting the right FHA-accepted bank is a decision that dictate the convenience and you may success of your loan software. On the sea regarding lenders, DSLD Financial stands out as the a beneficial beacon regarding reliability, giving expert suggestions from the FHA mortgage techniques. Financing Officials such as Chad Theriot and Evelyn Maher render its possibilities toward table, making certain you’re better-told and you will convinced at each and every step.

With DSLD Home loan, you aren’t just making an application for financing; you happen to be entering a pursuit that have a trusted partner at the front side.

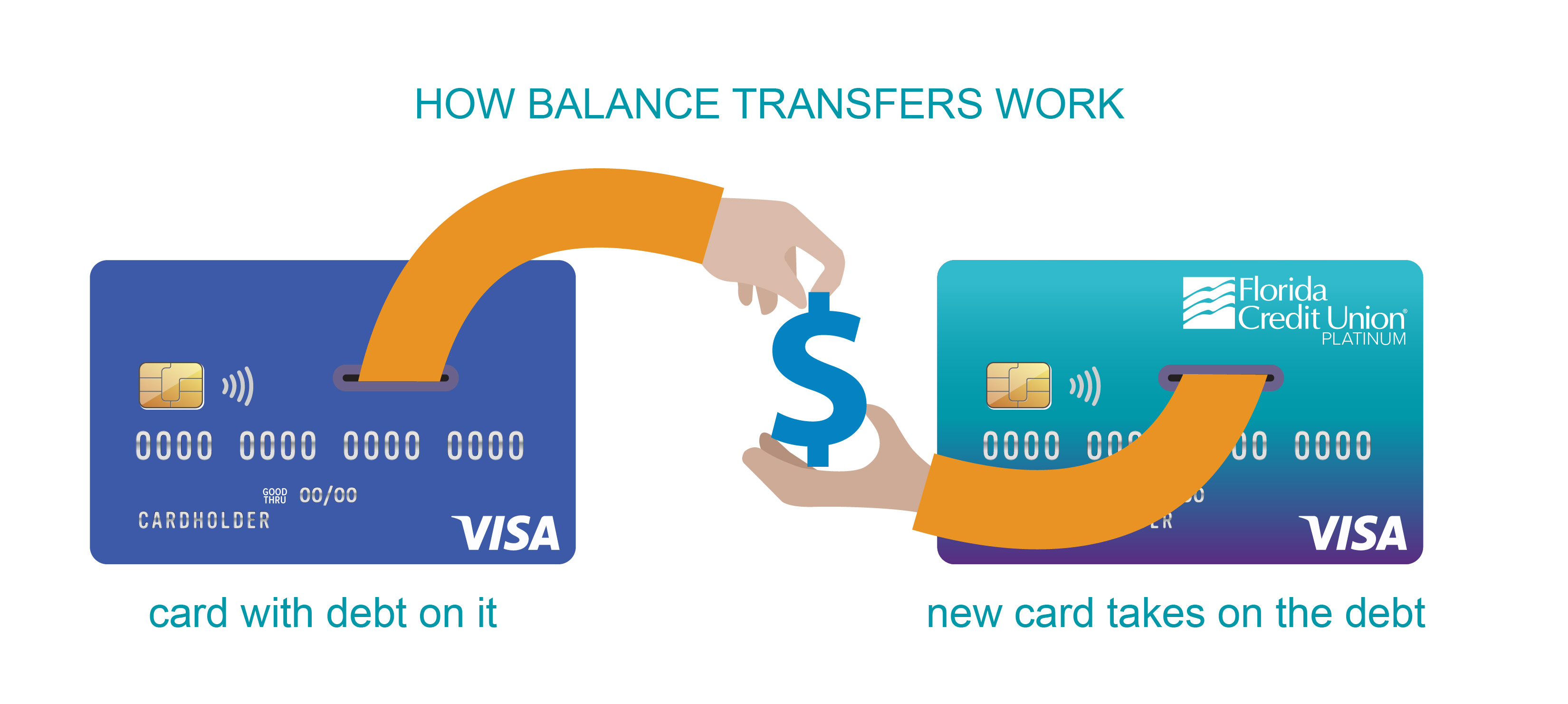

Financial insurance premiums with the FHA loans is sometime like the levees over the Mississippi-important defenses that come with the brand new region. Property owners which have FHA funds inside the Louisiana pay home loan insurance premiums (MIP) to shield loan providers in case of standard. An initial premium of just one.75% of your amount borrowed is usually financed toward mortgage, that helps do away with 1st costs. In addition, this new yearly financial premium are utilized in monthly installments, differing ranging from 0.45% and step one.05% considering individuals things.

These superior is a swap-from to the benefits of lower down money and much more easy credit requirements. For consumers that have less than a good ten% downpayment, MIP try a lengthy-term union, kept to your lifetime of the loan, if you are people with a top deposit will get take pleasure in a shorter MIP term. It is a key component of your FHA mortgage framework, built to maintain the stability and you can access to of one’s program to have most of the inside.

Special Considerations to have Earliest-Go http://www.clickcashadvance.com/installment-loans-ct out Homeowners during the Louisiana

Special software provided from Louisiana Construction Enterprise bring a portion hands, giving down payment guidance and tax loans and work out you to definitely earliest house pick a great deal more attainable. So you can be considered, someone ought not to provides owned a home before three ages, beginning the entranceway for most to step onto the possessions steps.

The MRB Assisted Program, for example, now offers cuatro% guidelines for deposit and you may settlement costs, once the MRB Domestic system can provide more, ranging from 5-9% with regards to the amount borrowed. These attempts are manufactured towards dreamers in mind, those troubled to make an important in the front home regarding unique slice from Louisiana, guaranteeing the financial weight away from first home-buying will set you back doesn’t substitute the method.

Increasing Their FHA Financing Positives which have DSLD Home loan

To genuinely use a complete potential off an FHA loan inside Louisiana, partnering which have an educated and buyers-focused financial is key. DSLD Mortgage, through its custom financing selection, serves a spectral range of people, out of people with incomplete credit to help you army team and you can entrepreneurs. Their dedication to getting an exceptional customers experience is reflected in the radiant recommendations in addition to their track record of closing into land 30% shorter versus business average.

Because of the working with DSLD Home loan, you just take advantage of the systems in addition to off their commitment to your home-to acquire achievement. Their Mortgage Officers, applauded for their customer-centered approach, lead you by way of a smooth closing travels. It is more about more than just protecting a loan-it’s about authorship property-purchasing feel that’s designed into unique tale.

Summary

Just like the the travel through the abundant landscape away from Louisiana FHA funds involves a close, we reflect on the brand new paths we have traversed-from knowing the basics of those comprehensive financing to help you decryption brand new financial realities and you may unlocking the fresh new doorways so you can homeownership. These types of money sit just like the a testament towards the odds of purchasing a property, it doesn’t matter if you’re a professional customer otherwise delivering your first tentative methods towards markets. Toward right advice, the support out-of an FHA-recognized lender particularly DSLD Home loan, as well as the strength of Louisiana heart, the brand new think of owning a home is not just possible but in this arm’s visited.