Fundamentally a deposit are gathered to cover the can cost you of an assessment and credit history and will or might not be refundable

Borrowing Repository – A place one to collects, maintains, places and sells economic and you can in public areas recorded information regarding the fresh new percentage suggestions men and women trying to get borrowing from the bank.

May be used with genuine transformation to choose whether bucks or borrowing from the bank was fueling development. Frequency: month-to-month. Source: Federal Reserve.

Problems – Extent recoverable because of the a person who might have been hurt within the people fashion from the act otherwise default of another.

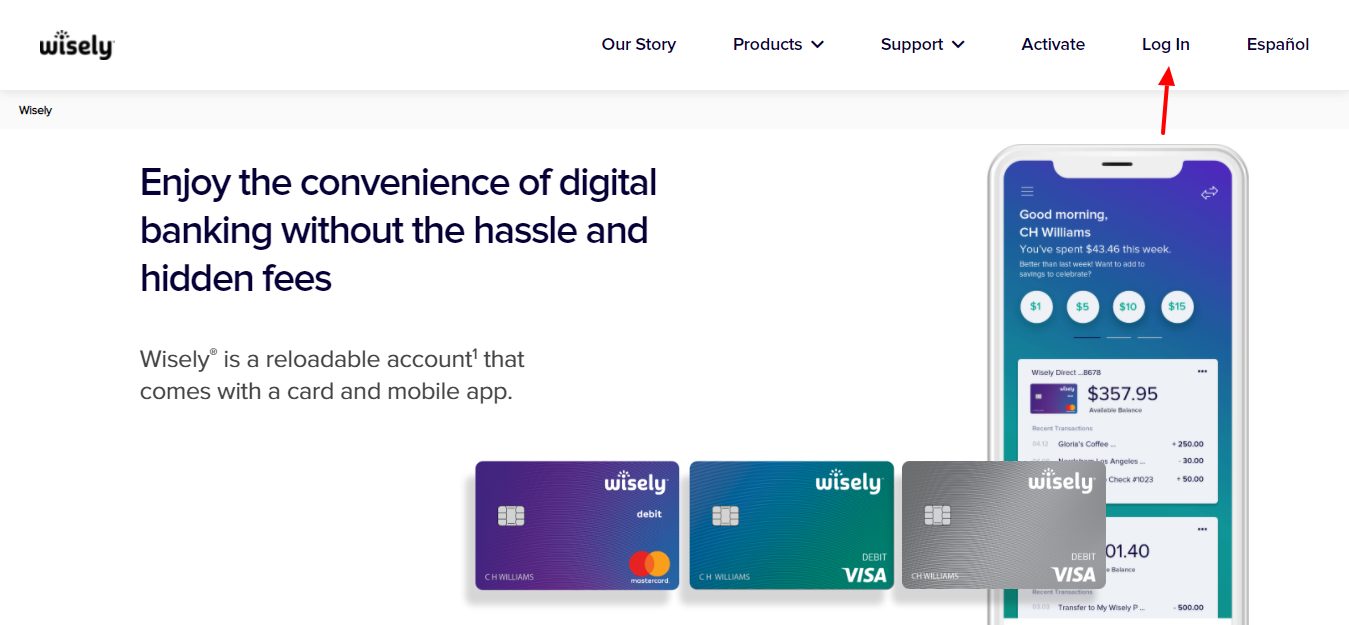

Debit Cards (EFT) – A plastic card and that seems just like credit cards, one people can use and then make requests, distributions, or any other style of digital finance transmits.

Deed – New created appliance one to conveys property in the vendor in order to the buyer. The fresh action is filed at the regional courthouse and so the import out-of control falls under the general public record.

Action regarding Believe – So it document, known as a home loan in certain claims, pledges a home so you can a lender or trustee once the protection to have the fresh new repayment out-of a debt.

Deed Stamp – A taxation that is required in certain municipalities if a house transform give. The level of so it taxation can vary with each state, urban area and you may condition. For the testing intentions, that it fee is a tax and other inevitable commission.

Deed-in-lieu – A procedure that lets a debtor to transfer the latest control of a home into the financial to avoid death of the house or property by way of property foreclosure.

Deposit – Money necessary for a loan provider in advance of the brand new control regarding that loan demand

Standard – A beneficial breech of contract which have a loan provider including the inability and come up with mortgage money on time.

Delivery Percentage – A fee billed essentially by the label organization or attorney to have the latest birth of files into the bank. In regards to our comparison intentions, the fresh beginning percentage is recognized as being a 3rd party fee.

Agency away from Experts Things (VA) – An agency of the authorities that give qualities and you will promises home-based mortgage loans made to eligible experts of your army qualities

Disregard Facts – Charges https://paydayloanalabama.com/gadsden/ which can be accumulated by the bank in return for an excellent all the way down rate of interest. Each discount point is 1% of your loan amount. For our analysis motives, a savings section is recognized as being a loan provider fee. To choose if it is smart to shell out dismiss items to obtain less rates, you must evaluate new in advance price of the factors to the brand new monthly offers one to originate from having the lower rates. Either described as “points”.

Write off Price – The rate that the Federal Set aside charge affiliate banking institutions to have fund, having fun with bodies bonds otherwise eligible report while the guarantee. This provides you with a floor on the interest rates, due to the fact finance companies set its loan pricing a notch over the write off price.

Document Preparation – Lenders tend to prepare yourself some of the courtroom data files that you will getting finalizing during closing, like the home loan, notice, and you can basic facts-in-lending report. Which fee covers the expense regarding the planning of these records. For the comparison purposes, the fresh new file planning fees are believed become a lender fee.

Documentary Stamp – A taxation levied by the specific regional otherwise condition governing bodies from the go out this new deeds and you may mortgage loans try joined towards the personal listing. For the review motives, documentary seal of approval are considered is a tax and other inescapable fee.

Deposit – The latest portion of the cost out-of property that debtor could well be spending in the bucks in the place of within the financial amount.